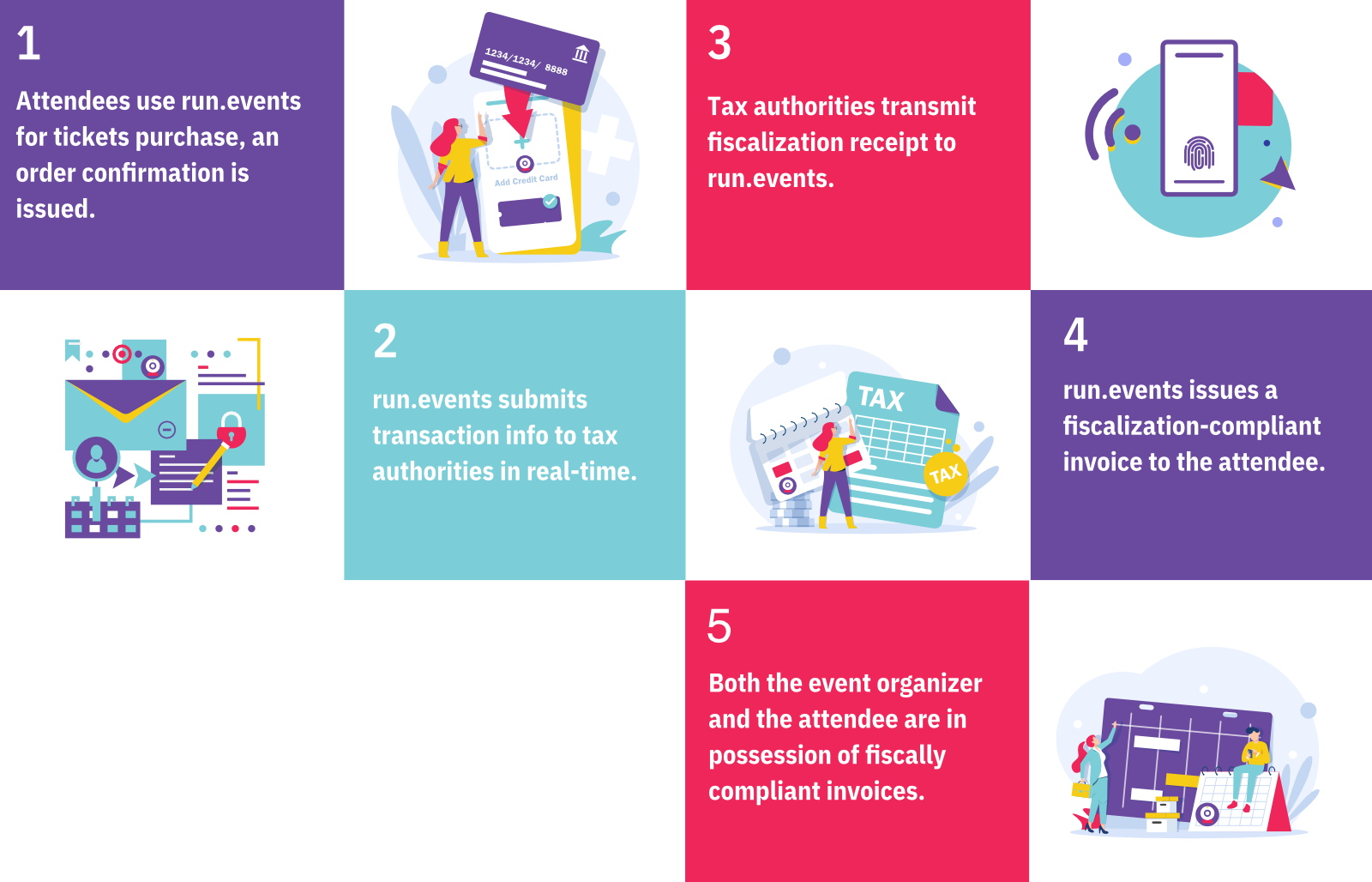

In the ever-evolving landscape of fiscal compliance, run.events stands at the forefront as the first Event Management Platform to fully support fiscalization and real-time fiscal reporting. This groundbreaking feature is a game changer for event organizers, attendees, and the event industry at large, particularly in the ever-growing number of European countries where invoice fiscalization and real-time reporting are mandatory.

Why Fiscalization Matters in the Event Industry

Fiscalization, the process of electronically recording and validating financial transactions for taxation purposes, as well as its direct and real-time reporting to tax institutions, is vital for ensuring compliance with diverse tax regulations

across Europe. Different countries have adopted various

fiscalization methods, be it hardware, software, a combination of both, or purely online systems.

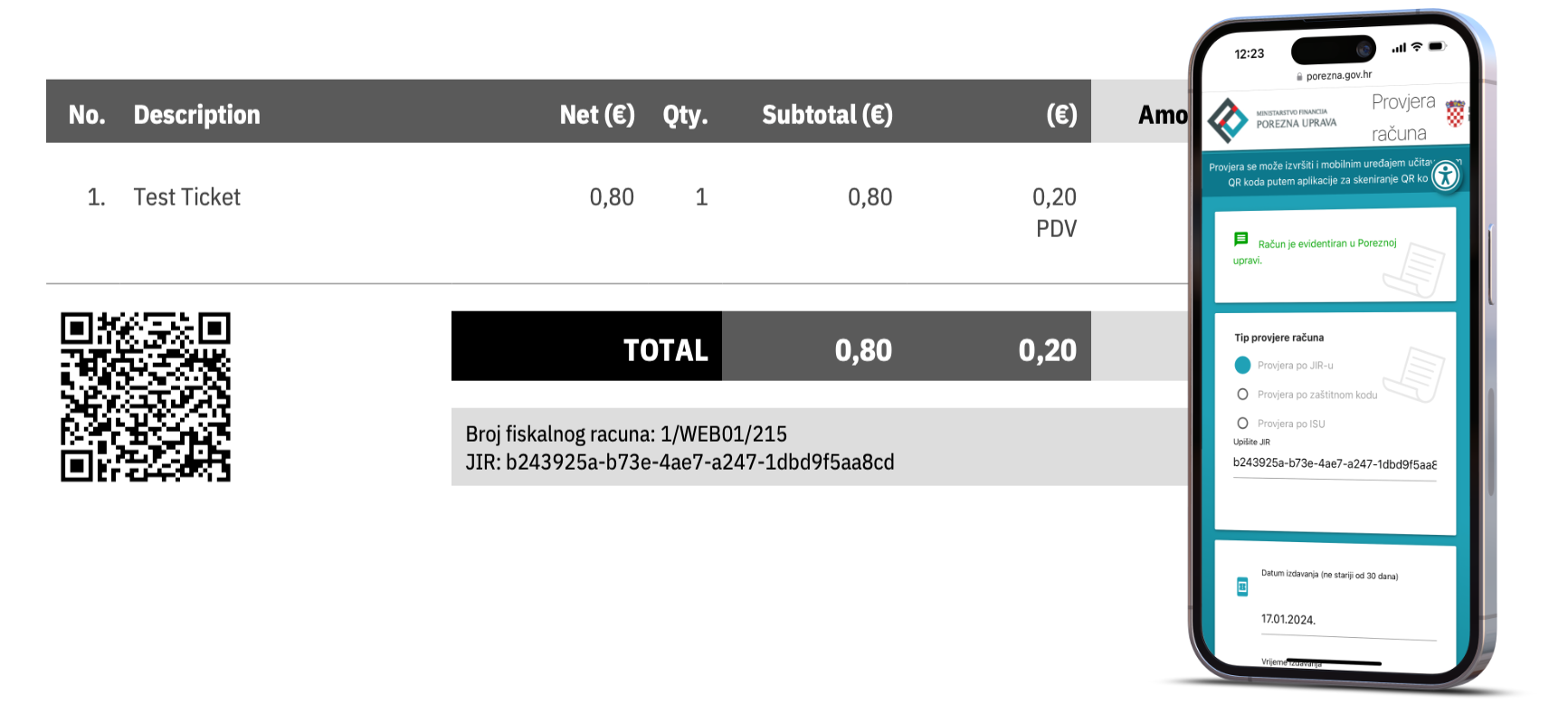

Also, an ever-growing number of countries require real-time invoice fiscalization and reporting, which means that issued invoices must be reported to the tax authorities the moment they are issued, and that a fiscalization ID issued by the tax authority must be printed on the invoice itself.

This impacts all invoices issued to event attendees, which are paid by any means other than wire transfer. Invoices paid by credit card payments, various online payment services, as well as cash-on-entrance, are all subject to fiscalization and real-time reporting for the event organizers who are organizing events in the countries which adopted this approach. And the number of countries going down this path in Europe and otherwise is increasing year after year.